Liu, "Understanding Drawdowns", working paper, Carr Futures (September 4), 2003 International Journal of Theoretical and Applied Finance. "Drawdown Measure in Portfolio Optimization" (PDF).

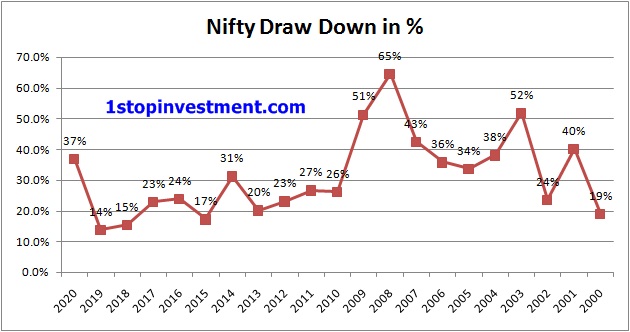

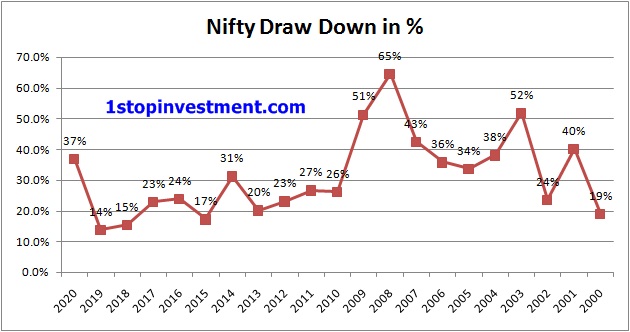

^ Chekhlov, Alexei Uryasev, Stanislav Zabarankin, Michael (2005). "Portfolio Optimization with Drawdown Constraints" (PDF). ^ Chekhlov, Alexei Uryasev, Stanislav Zabarankin, Michael (2003). "On the Maximum Drawdown of a Brownian Motion" (PDF). When X is a vector of portfolio returns, that is defined by: So it could be the time when the program also had its biggest peak to valley loss (and usually is, because the program needs a long time to recover from the largest loss), but it doesn’t have to be. The Max DD duration is the longest time between peaks, period. Many assume Max DD Duration is the length of time between new highs during which the Max DD (magnitude) occurred. The max drawdown duration is the worst (the maximum/longest) amount of time an investment has seen between peaks (equity highs). How long it lasts (the duration) The drawdown duration is the length of any peak to peak period, or the time between new equity highs. These measures can be considered as a modification of the Sharpe ratio in the sense that the numerator is always the excess of mean returns over the risk-free rate while the standard deviation of returns in the denominator is replaced by some function of the drawdown.Ģ. In finance, the use of the maximum drawdown as an indicator of risk is particularly popular in the world of commodity trading advisors through the widespread use of three performance measures: the Calmar ratio, the Sterling ratio and the Burke ratio. The Maximum Drawdown, more commonly referred to as Max DD, is the worst (the maximum) peak to valley loss since the investment’s inception. How low it goes (the magnitude) Put plainly, a drawdown is the “pain” period experienced by an investor between a peak (new highs) and subsequent valley (a low point before moving higher) in the value of an investment. There are two main definitions of a drawdown:ġ. Only get updated when higher DD is seen.Įnd if end for Trading definitions

# Same idea as peak variable, MDD keeps track of the maximum drawdown so far. # peak will be the maximum value seen so far (0 to i), only get updated when higher NAV is seen Drawdown and Max Drawdown are calculated as percentages:

The following pseudocode computes the Drawdown ("DD") and Max Drawdown ("MDD") of the variable "NAV", the Net Asset Value of an investment.

0 kommentar(er)

0 kommentar(er)